In its Economic and Fiscal Update for Fall 2021, which was released on December 14, 2021 the Department of Finance introduced a proposed tax credit available to farm businesses with the intention of effectively refunding proceeds from the Federal fuel charge carbon tax program to farmers. The proposed tax credit will be available starting in 2021 to farm businesses in any of the provinces that do not meet the federal stringency requirements (referred to as “backstop jurisdictions”)—currently, Ontario, Manitoba, Saskatchewan and Alberta.

Eligible farming businesses include self-employed farmers (individual, corporations, or trusts) and partners in farming partnerships that meet the following conditions:

- They actively engage in either the management of, or daily activities related to, the earning of income from farming; and,

- They incur total farming expenses for all businesses of $25,000 or more, which are all or partially attributable to designated provinces.

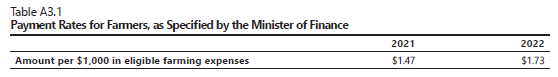

Legislation for this tax credit has been drafted as part of Bill C-8 “An Act to implement certain provisions of the economic and fiscal update table in Parliament on December 14, 2021 and other measures”, which has not yet been passed as of the date of writing. However, the draft legislation proposes that the rebate would provide a tax credit to eligible farm businesses at the following rates based on the total “Eligible Farming Expenses” incurred for the year:

Eligible farming expenses for the purpose of the tax credit calculation can include any expense that is deductible in calculating taxable farming income for the year, with the exception of Optional or Mandatory Inventory Adjustments, or expenses incurred in non-arm’s length transactions (expenses paid to related individuals or other related entities such as corporations or trusts).

Where taxation years do not align with the calendar year, eligible farming expenses would be allocated to each calendar year based on the number of days in each calendar year over the total days in the taxation year, and subjected to the applicable payment rate for the calendar year. For example, if a corporation has a taxation year that starts on July 1, 2021 and ends on June 30, 2022, its eligible farming expenses would be prorated to both the 2021 and 2022 calendar years according to the proportion of days in each year.

Although the Federal government has made form T2043 Return of Fuel Charge Proceeds to Farmers Tax Credit available for calculation and reporting of the available credit, taxpayers should hold off on claiming this credit with their tax returns until the legislation has passed, as the details and administration of this program will be subject to change until the legislation contained in Bill C-208 has received royal assent.

For questions on the Return of Fuel Charge Proceeds to Farmers Tax Credit including eligibility and how to apply, contact Gregory Harriman & Associates LLP by email at This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone at 1-403-934-3176.