As 2022 draws to a close we would like to take this opportunity to say a sincere Thank You to all of our clients and to pass on our Best Wishes to you and your families this Holiday Season!

This edition of the Christmas Letter will offer some important updates regarding personal and corporate tax matters, including some important points from the 2022 Fall Economic Statement. We’ve also included some valuable tools and tips to help manage your business and your accounting needs.

Important Points from the 2022 Fall Economic Update

On November 3, 2022, the Department of Finance released its 2022 Fall Economic Statement, outlining several new economic proposals put forward by the federal government, as well as updates on some important previously announced financial and tax measures.

A few key points from the Fall Economic Statement, and related legislation introduced in Bill C-32 are as follows:

-

Implementation of the newly expanded reporting requirements in respect of trusts has been delayed, and will now apply for trusts with a year end after December 30, 2023 (previously slated to begin December 31, 2022). These new trust reporting rules require additional information to be disclosed for beneficiaries, settlors, trustees and certain other persons involved with trusts. The proposed legislation also introduces a requirement for all “bare trusts” to file a T3 return annually in order to report this additional information.

-

The Department of Finance confirmed its intention to proceed with implementing the new Tax-Free First Home Savings Account. This new account will allow prospective first-time home buyers to save up to $40,000 tax-free towards the purchase of their first home. Like an RRSP, contributions would be tax-deductible, however, withdrawals to purchase a first home—including investment income—would be non-taxable, like a TFSA. Tax-free in; tax-free out. The government expects that Canadians will be able to open and begin contributing to an account in mid-2023. CPA Canada has recently released a useful Tax-Free First Home Savings Account blog answering some frequently asked questions in relation to this new program.

-

Proposal for a new refundable tax credit equal to 30 per cent of the capital cost of investments in:

-

-

Electricity Generation Systems, including solar photovoltaic, small modular nuclear reactors, concentrated solar, wind, and water (small hydro, run-of-river, wave, and tidal);

-

Stationary Electricity Storage Systems that do not use fossil fuels in their operation, including but not limited to: batteries, flywheels, supercapacitors, magnetic energy storage, compressed air storage, pumped hydro storage, gravity energy storage, and thermal energy storage;

-

Low-Carbon Heat Equipment, including active solar heating, air-source heat pumps, and ground-source heat pumps; and,

-

Industrial zero-emission vehicles and related charging or refueling equipment, such as hydrogen or electric heavy-duty equipment used in mining or construction.

-

The credit would be available as of the day of Budget 2023 and no longer in effect at the start of 2035, subject to a phaseout starting in 2032.

-

Implementation of the new Mandatory Reporting rules and Notifiable Transactions rules will be delayed until the related legislation has received royal assent. These rules were previously slated to be implemented effective for transactions occurring on January 1, 2023 or later. These rules would require taxpayers and advisors to provide additional disclosure to CRA in relation to transactions undertaken to achieve a tax benefit and where certain conditions are met. The intention of these proposals is to discourage certain types of more aggressive tax planning; however, CPA Canada has expressed concern over the broadly worded legislation and potential that it may unintentionally include some more routine tax planning transactions.

-

Confirmation of the Department of Finances intention to move forward with several previously announced measures from the 2022 federal budget and other previous announcements, including:

-

-

Expansion of eligibility for the Small Business Deduction and related reduction of the federal corporate tax rate. Starting with taxation years beginning on or after April 7, 2022, budget 2022 proposes to phase out access to the small business tax rate more gradually, with access to be fully phased out when taxable capital reaches $50 million, rather than the current $15 million threshold.

-

Review of the Alternative Minimum Tax regime, with proposal for a new minimum tax regime to be implemented. A detailed proposal and path for implementation will be released in Budget 2023.

-

Residential Property Flipping Rules. This proposal aims to implement rules providing for the taxation of the sale of residential properties within 12 months from the original purchases as business income (i.e. not subject to capital gains tax rates or the Principal Residence exemption), subject to certain exclusions for “life events”.

-

Underused Housing Tax and related legislative amendments to the Underused Housing Tax Act. Starting with the 2022 tax year, this new legislation will impose a 1% annual tax on the value of non-resident, non-Canadian owned residential real estate that is considered to be vacant or underused. The Certain other individuals (including Canadian Controlled Private Corporations, partnerships, and Canadian resident trusts) may also have an annual filing requirement, even if they meet one of the legislated exemptions to pay the Underused Housing Tax. The Underused Housing Tax return for the 2022 calendar year will be due on or before April 30, 2023, and significant penalties can apply for failing to file even if you do not owe tax. UPDATE - For more details on the UHT and related filing requirements, see the Canada Revenue Ageny's Underused Housing Tax Notices released in January 2023.

-

New Temporary Cost of Living Measures

Throughout 2022 the Department of Finance announced several temporary or one-time measures aimed at helping to offset the impact of inflation for lower income Canadians. Several of these new measures were also confirmed in the November 3, 2022 Fall Economic Statement (see discussion above) and include the following:

-

The Canada Dental Benefit - In September 2022, the government introduced legislation to implement the Canada Dental Benefit, to provide eligible parents or guardians with direct, up-front tax-free payments to cover dental expenses for their children under 12-years-old.For those without dental coverage and with an annual family income under $90,000 per year, the Canada Dental Benefit will provide payments of up to $650 per year, over the next two years. Applications for the Canada Dental Benefit will open on December 1, 2022. Visit the CRA’s Canada Dental Benefit website for more details on how to apply.

-

Doubling the GST Credit for Six Months - Starting November 4, 2022, an estimated 11 million low and modest-income current GST Credit recipients will automatically receive an additional payment. Single Canadians without children will receive up to an extra $234, and couples with two children will receive up to an extra $467. Seniors will receive an extra $225 on average.

-

A Top-Up to the Canada Housing Benefit - Building on the Canada Housing Benefit, introduced in 2020, the government introduced a $500 top-up to the Benefit. Upon Parliamentary approval, it will deliver a tax-free payment directly to 1.8 million low-income renters who are struggling with the cost of housing. The federal benefit will be available to applicants with an adjusted net income below $35,000 for families, or below $20,000 for single Canadians, who pay at least 30 per cent of their income towards rent.

-

A New, Quarterly Canada Workers Benefit – This benefit will be delivered through tax returns, meaning Canadians who receive it need to wait until the tax year is over to receive the support. The CWB would provide up to $1,428 for single workers or up to $2,461 for a family this spring through the existing tax return payment, and then new advance payments for 2023 across three quarterly advance payments starting in July.

Given that these new measures are income dependent and are only available to taxpayers that have filed their personal income tax returns, this may provide yet another reason for low-income individuals to file their personal tax returns, even if they don’t owe tax.

Reminder on Immediate Expensing Rules

In the April 19, 2021 Federal Budget, the Department of Finance announced proposed new measures allowing for the immediate expensing of certain depreciable capital assets. These new provisions finally received royal assent on June 23, 2022, and will allow Canadian Controlled Private Corporations (CCPC’s), Canadian individuals (other than trusts) and Canadian partnerships to deduct the full cost of eligible purchases made:

-

After April 18, 2021 and before January 1, 2024 for Canadian Controlled Private Corporations

-

After December 31, 2021 and before January 1, 2025 for individuals

-

After December 31, 2021 and before January 1, 2024 for partnerships where not all of the members are individuals

The deduction is available in the year that the asset becomes available for use, accelerating what can often be a significant deduction to reduce taxes owing.

For more information on these immediate expensing rules, visit our blog page.

Canada Emergency Business Account (CEBA) – Updated Payment Deadline

The Government of Canada has extended the December 31, 2022 repayment date to December 31, 2023 for CEBA loan holders.

If your business took advantage of the Canada Emergency Business Account (CEBA) loan intended to provide loan assistance of up to $60,000 for small businesses during the COVID-19 pandemic, you will be contacted by your financial institution with details for your specific loan.

IMPORTANT TIP - When repaying your CEBA loan, review the information provided by your bank carefully to ensure that you are not unintentionally repaying the forgivable portion of your loan, as this amount cannot be recovered once it has been repaid.

For additional details, visit the Government’s Canada Emergency Business Account (CEBA) webpage.

Tax Treatment of Cryptocurrency

With more and more individuals investing and transacting in cryptocurrency each year, the CRA has recently provided comments on the tax treatment of cryptocurrency and their interpretation of how transactions involving the sale of cryptocurrency should be treated for tax purposes. If you have dealt in cryptocurrency or currently hold cryptocurrency as an investment, here are a few things to know from a tax perspective:

-

Capital Gain or Income – The CRA generally treats cryptocurrency like a commodity for purposes of the Income Tax Act. Any income from transactions involving cryptocurrency is generally treated as business income or as a capital gain, depending on the circumstances. If the nature of your activities in trading crypto currency is similar in nature to a “business” then the CRA may consider that you are engaged in a business of trading crypto currency and that any income realized from trading cryptocurrency should be treated as business income. On the other hand, if your level of activity in trading crypto currency is not sufficient to be considered a “business” then any gains from trading would be treated as capital gains for tax purposes.

-

Foreign Property – The CRA is currently reviewing whether cryptocurrency must be reported on form T1135 “Foreign Income Verification Statement”. If you held an investment in cryptocurrency at any point during the year, make sure you advise your accountant so that they can consider whether it needs to be reported on a T1135 form.

-

GST – Where a taxable property or service is exchanged for cryptocurrency, the GST/HST that applies to the property or service is calculated based on the fair market value of the cryptocurrency at the time of the exchange. If your business accepts cryptocurrency as payment for taxable property or services, the value of the cryptocurrency for GST/HST purposes is calculated based on its fair market value at the time of the transaction.

For more information on the tax treatment of crypto currency, visit the CRA’s Guide for cryptocurrency users and tax professionals webpage.

Changes to the Disability Tax Credit

On June 23, 2022 Bill C-19 received royal assent. This legislation amended the Income Tax Act to allow for increased access to the Disability Tax Credit under the following situations:

-

Impaired Mental Functions – Additional consideration for impaired mental functions, including attention, concentration, memory, judgement, perception of reality, problem-solving, goal-setting, regulation of behavior and emotions, verbal and non-verbal comprehension and adaptive functioning.

-

Type 1 Diabetes – Individuals suffering from Type 1 diabetes can now qualify for the Disability Tax Credit, regardless of time spent on life-sustaining therapy.

-

Life-Sustaining Therapy – Reduction of threshold to qualify for disabilities requiring life-sustaining therapy to two times per week (previously three) for an average of at least 14 hours per week.

Both the Disability Tax Credit application form T2201 as well as the CRA online Disability Tax Credit Application have now been updated to reflect these changes.

Any person who applied and was denied the DTC under mental functions or life sustaining therapy since January 1, 2021, does not need to reapply! Applications received on, or after January 1, 2021 to June 2023, 2022, will be reviewed under the revised criteria.

How to Choose the Bookkeeping Software That’s Right for Your Business

Choosing the best bookkeeping software can be a difficult task as it is not always obvious which software will provide the right features to fit your business’s needs. There are many software programs out there that may or may not fit with the nature or scale of your business operations or may not address industry specific needs.

Check out our recent blog for more details on how to find the best fit four your business bookkeeping software.

Did You Know?

-

The interest rate on overdue taxes for the fourth quarter of 2022 (October 1 – December 31, 2022) has increased by 1% to 7%. Make sure to get those payments in to CRA on time!

-

No input tax credit (ITC) can be claimed if the vendor does not have a valid GST/HST number at the time of the transaction. You can check the validity of an entity’s GST/HST business number at CRA’s online “GST/HST registry.”

-

There are approximately $1.4 billion in uncashed cheques in CRA’s bank accounts. Even cheques that are over a decade old can be reissued. Call CRA or visit your CRA “My Account” online to check whether you have an uncashed cheque.

-

On November 14, 2022 the Government announced an increase in the annual TFSA contribution limit for 2023 to $6,500. This limit is up $500 from the 2022 annual contribution limit of $6,000. An individual who has been eligible to contribute since the TFSA’s introduction in 2009, but has not yet contributed would have total contribution room of $88,000 available in 2023.

-

The Temporary Flat-Rate Method to claim a deduction for home office expenses on your personal income tax return has been extended to the 2022 tax year. If you worked more than 50% of the time from home for a period of at least four consecutive weeks in the year due to the COVID-19 pandemic, you can claim $2 for each day you worked from home during that period. You can then also claim any additional days you worked at home in the year due to the COVID-19 pandemic. The maximum amount that can be claimed is $400 per individual in 2020 and $500 per individual in 2021 and in 2022. This method can only be used for the 2020, 2021 and 2022 tax years. For more information on how to claim a deduction for home office expenses visit the CRA Home office expenses for employees webpage.

-

On November 1, 2022 the CRA announced the following CPP rate enhancements for 2023:

-

The maximum pensionable earnings under the Canada Pension Plan (CPP) for 2023 will be $66,600—up from $64,900 in 2022.

-

The employee and employer contribution rates for 2023 will be 5.95%—up from 5.70% in 2022, and the self-employed contribution rate will be 11.90%—up from 11.40% in 2022.

-

The maximum employer and employee contribution to the plan for 2023 will be $3,754.45 each and the maximum self-employed contribution will be $7,508.90. The maximums in 2022 were $3,499.80 and $6,999.60 respectively.

-

-

The following Employment Insurance program rate changes have also been announced for 2023:

-

The 2023 maximum Insurable Amount will increase from $60,300 to $61,500. This means that an insured worker will pay EI premiums in 2023 on insured earnings up to $61,500.

-

In 2023, the employee EI premium rate will be $1.63 per $100. This premium rate and the MIE increase means that insured workers will pay a maximum annual EI premium in 2023 of $1,002.45 compared with $952.74 in 2022.

-

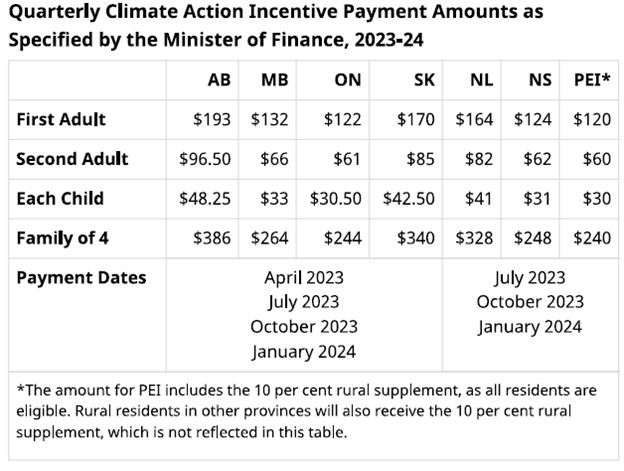

Climate Action Incentive Payments for 2023-2024

The Federal Government recently announced Climate Action Incentive payment rates for 2023-2024. These payments are issued quarterly to Canadian households. The table below shows the approved rates for payments starting in April 2023:

Update on CRA Account Services

As part of Small Business Week 2022, the CRA released a Tax Tip on October 17, 2022, outlining some of the new and existing CRA services available for small business taxpayers. The full notice can be found at the link below, and discusses changes to the CRA MyBusiness account, digital services offered for businesses, and other relevant CRA programs available for small businesses.

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2022/small-business-week-2022-cra-year-round-help-small-businesses-unique-needs.html

CRA Tax Tip – How to Pay your Business Taxes Online

If you are a business owner and are not yet set up to pay your business taxes online, the CRA has recently released a tax tip on how you could save significant time by setting up online payments for all your business tax accounts (i.e., income tax, GST, and payroll). Check out the link below for details.

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2021/businesses-pay-taxes-online-directly-financial-institution-directly-cra.html

How to Protect Yourself from CRA Scams

The Canadian Anti-Fraud Centre reported that Canadians lost almost $381 million to fraud in 2021. We want to ensure that clients are educated on how to protect themselves.

One-way scammers will try to commit fraud is through acting as CRA. Whenever you are contacted by CRA, it is important to always ensure that you are able to identify if it is really CRA that you are speaking to.

CRA WILL contact you via phone, email or mail. CRA WILL NOT contact you via text message or instant messaging such as Facebook Messenger or WhatsApp.

To verify your account, CRA may ask for your:

-

Name

-

Date of Birth

-

Social insurance number

-

Details of your account (such as information from your tax return)

CRA will NEVER:

-

Threaten you with arrest or jail time

-

Ask for your passport number, driver’s license number, or any personal financial information

-

Send threatening emails or voicemails

-

Ask you to make immediate payment via e-transfer, bitcoin, prepaid credit card or gift cards

Steps to take if you receive a suspicious call:

-

Request the Caller’s Name, Agent ID, Phone Number, and office location

-

Tell them you want to verify their identity

-

Then call CRA at 1-800-959-8281 (for individuals) or 1-800-959-5525 (for business) to confirm that they are a legitimate agent

Other Scams - Another scam that GH&A has been made aware of is when a scammer will impersonate a trusted advisor and note for an individual or corporation to make their tax payment (Corporate, Provincial, GST or Payroll) via a wire transfer.

These institutions would never request a wire transfer payment. In addition, GH&A would never provide you with wire transfer information to make any type of tax payment.

For more information on how to protect yourself from scams and fraud visit the Canadian Anti-Fraud Centre website.

Vehicle Mileage Tracker Apps

For any business owner claiming a mileage expense for the business use of a personal vehicle, the most important documentation to retain in support of the expense claimed is a logbook with details of business trips made during the year. There are a number of useful apps available for download that can be used to assist with vehicle mileage tracking including, in some cases, the automatic tracking of distance travelled. Below are some of the smartphone applications and other tools available:

-

MileIQ - https://www.mileiq.com/

-

Driversnote - https://www.driversnote.com/

-

Odotrack – https://odotrack.com/en/

Staff Announcements

In 2022 we welcomed Charmaine Bruinsma, Ali Cardenas, and Brenda De La Mare to our team.

Welcome back Erin Gregory and Jodee McKinnon after their returns from maternity leave!!

Community Involvement

The staff of GH&A are proud to be involved with the following organizations in our community:

-

Rita’s Parish Council in Rockyford

-

Strathmore & Wheatland Chamber of Commerce

-

Standard Lionettes

-

Strathmore & Wheatland County Christmas Hamper Society

-

Standard & District Ag Society

-

Standard Municipal Library

-

Strathmore & District Curling Club

-

Wheatland & Area Hospice Society

-

East Wheatland Athletic Association

-

Village of Standard

-

Special Olympics, Calgary

-

Community Improvement Program – Town of Strathmore

-

Royal Canadian Sea Cadet Corps 344 Victoria

-

Strathmore & District AG Society

Social Media

Be sure to follow GH&A on social media for frequent updates and information on accounting and tax changes.