On March 28, 2023, the Department of Finance introduced the 2023 Federal Budget for Canada, titled “A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future”. Although this year’s version of the budget contained fewer significant tax measures as compared to budgets from years past, there were still a few important tax implications for Canadian taxpayers to be aware of as summarized below.

What Was NOT Included in the Budget

Perhaps more significant than the tax measures that were introduced in the 2023 Federal Budget was what was notably absent from the budget. Specifically, there were no changes announced to the following items:

-

Personal tax rates

-

Corporate tax rates

-

Capital gains inclusion rate

-

Lifetime Capital Gains Exemption limits for Qualified Farm Property and Qualified Small Business Corporation Shares

Changes to the Alternative Minimum Tax (AMT) Rules

As part of the 2022 Federal Budget, the Department of Finance had announced its intention to review and overhaul the existing Alternative Minimum Tax rules. The AMT rules provide for a separate tax calculation on income in excess of a legislated basic exemption ($40,000 under existing rules). This calculation ignores or reduces consideration for certain deductions from income.

The result is that in circumstances where a deduction is claimed that results in a significant reduction of tax otherwise payable on certain types of income (this commonly applies when there is a Capital Gains Deduction claimed on a disposition of Qualified Farm Property or Qualified Small Business Corporation shares), AMT is payable to the extent that this AMT calculation exceeds the amount of basic tax payable. When AMT is payable for a taxation year, it can be carried forward up to seven future tax years, and claimed as a credit to reduce taxes payable to the extent regular tax exceeds AMT in those years.

The 2023 Federal Budget delivered on the Department of Finance’s promise, and provided the following significant revisions to these AMT rules effective starting with the 2024 personal tax year:

-

The AMT rate is increased from 15% to 20.5%

-

The amount of the basic AMT exemption is increased from $40,000 to $173,000 (meaning no AMT applies if total income for the year is less than $173,000)

-

The AMT capital gains inclusion rate is increased from 80% to 100%

-

Capital loss carry forwards and allowable business investment losses apply at a 50% rate

-

Additional deductions from income considered at a rate of 50% including the following:

-

Employment expenses, other than those to earn commission income

-

Deductions for Canada Pension Plan, Quebec Pension Plan, and Provincial Parental Insurance Plan contributions

-

Moving expenses

-

Child care expenses

-

Disability supports deduction

-

Deduction for workers’ compensation payments

-

Deduction for social assistance payments

-

Deduction for Guaranteed Income Supplement and Allowance payments

-

Canadian armed forces personnel and police deduction

-

Interest and carrying charges incurred to earn income from property

-

Deduction for limited partnership losses of other years

-

Non-capital loss carryovers

-

Northern residents’ deductions

-

It should be noted that the applicable inclusion rate for capital gains eligible for the lifetime capital gains exemption was not changed and remains at 30% as legislated in the existing rules. The carry-forward period of seven years to recover AMT in subsequent tax years also remains unchanged.

Since this revised framework for AMT does not come into effect until 2024, this could be an important planning point as the difference in AMT payable could be significant depending on whether a transaction occurs in 2023 (under the existing legislation), or in 2024 (under the new legislation).

Amendments to the Intergenerational Business Transfer Rules from Bill C-208

When Bill C-208 was originally passed into law on June 29, 2021, it introduced changes to the Income Tax Act that provided for an exception to section 84.1 of the Income Tax Act for certain share transfers from parents to corporations owned by their children or grandchildren. These amendments made it easier for owners of Canadian private corporations to transfer all or a portion of their business to their children, while achieving a tax result similar to what would be achieved from a sale of the business to an unrelated purchaser. From the moment that this legislation was passed, however, the Department of Finance expressed concern with perceived gaps in the legislation and the potential for abuse that this left in circumstances where the new legislation was relied on for planning that did not involve a genuine intergenerational business transfer.

As originally legislated on June 29, 2021, the amendments to section 84.1 did not require that:

-

the parent cease to control the underlying business of the corporation whose shares are transferred,

-

the child have any involvement in the business,

-

the interest in the purchaser corporation held by the child continue to have value, or

-

the child retain an interest in the business after the transfer.

The 2023 Federal Budget proposed several amendments to these rules which are aimed at ensuring that the exception to 84.1 applies only where a genuine intergenerational business transfer takes place.

To qualify under the new proposed rules, each share of the Transferred Corporation must be a “qualified small business corporation share” or a “share of the capital stock of a family farm or fishing corporation” (both as defined in the Income Tax Act), at the time of the transfer; and,

- the Purchaser Corporation must be controlled by one or more persons each of whom is an adult child of the Transferor (the meaning of “child” for these purposes would include grandchildren, step-children, children-in-law, nieces and nephews, and grandnieces and grandnephews).

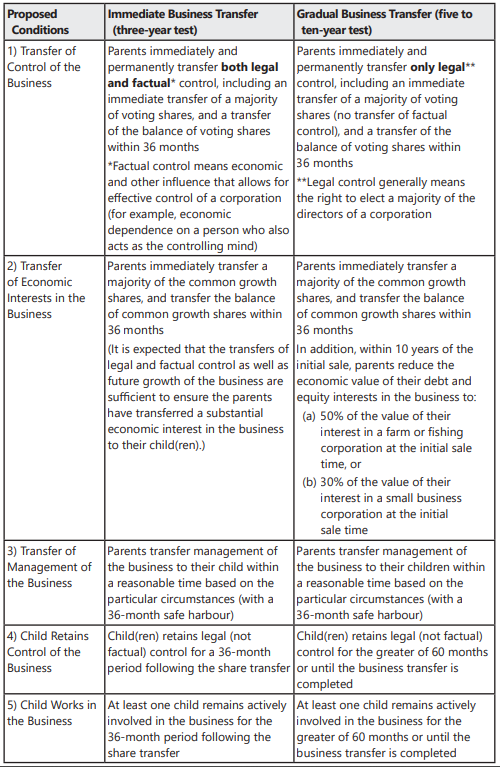

The new proposals also add a requirement that taxpayers who wish to undertake a genuine intergenerational share transfer must choose to rely on one of two transfer options:

- An immediate intergenerational business transfer (three-year test) based on arm’s length sale terms; or

- A gradual intergenerational business transfer (five-to-ten-year test) based on traditional estate freeze characteristics (an estate freeze typically involves a parent crystalizing the value of their economic interest in a corporation to allow future growth to accrue to their children while the parent’s fixed economic interest is then gradually diminished by the corporation repurchasing the parent’s interest).

The following table outlines the proposed conditions to qualify as a genuine intergenerational business transfer under both options (transfers to grandchildren, nieces, and nephews would also qualify).

The rules introduced by Bill C-208 that apply to subsequent share transfers by the Purchaser Corporation and the lifetime capital gains exemption are proposed to be replaced by relieving rules that would apply upon a subsequent arm’s length share transfer or upon the death or disability of a child. There would be no limit on the value of shares transferred in reliance upon this rule.

The Transferor and child (or children) would be required to jointly elect for the transfer to qualify as either an immediate or gradual intergenerational share transfer. The child (or children) would be jointly and severally liable for any additional taxes payable by the Transferor, because of section 84.1 applying, in respect of a transfer that does not meet the above conditions. The joint election and joint and several liability recognize that the actions of the child could potentially cause the parent to fail the conditions and to be reassessed under section 84.1.

In order to provide the Canada Revenue Agency with the ability to monitor compliance with these conditions and to assess taxpayers that do not so comply, the limitation period for reassessing the Transferor’s liability for tax that may arise on the transfer is proposed to be extended by three years for an immediate business transfer and by ten years for a gradual business transfer.

Other Measures from the Budget

The above points are only a few of the more significant tax measures from the 2023 Federal Budget. For a comprehensive summary of the budget check out our Federal Budget Commentary 2023 page.

For questions about the 2023 Federal Budget and how its proposals may impact you or your business, contact Gregory Harriman & Associates LLP by email at This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone at 1-403-934-3176.

Disclaimer

The information in this publication is current as of June 9, 2023

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact Gregory, Harriman & Associates LLP to discuss these matters in the context of your particular circumstances. Gregory, Harriman & Associates LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.