An important, but commonly overlooked requirement for rental arrangements involving non-resident landlords, is the requirement under the Income Tax Act for the tenant to withhold non-resident tax from their regular rental payments and remit this tax to the CRA on the landlord’s behalf. The following are some key points to keep in mind if you are ever presented with the opportunity to rent property in Canada from a non-resident owner.

Non-Resident Withholding Responsibilities and Penalties for Non-Compliance

As a Canadian payer of rent to a non-resident, it is the tenant’s responsibility to withhold non-resident tax from rental payments and remit tax withheld to the CRA. You have to remit your non-resident tax deductions so that the Canada Revenue Agency (CRA) receives them on or before the 15th day of the month following the month the amount was paid or credited to the non-resident.

You must have a separate CRA non-resident tax account in order to begin remitting non-resident withholding tax. You can open a non-resident tax account online through My Account, My Business Account, or Represent a client. Once you have logged in, select “Open a non-resident tax account” from the menu. You can also contact the CRA at 1-855-284-5946. The CRA will give you a non-resident account number and tell you how to remit your deductions.

Non-Resident Withholding Tax Rates

Non-residents have to pay a 25% tax on amounts that are taxable under Part XIII (“Part XIII tax”). However, this rate can be reduced to a lower rate or an exemption can be given under the provisions of the Income Tax Act or a bilateral tax treaty between Canada and another country.

As the Canadian payer or withholding agent, you are responsible for withholding and remitting Part XIII tax at the correct rate, so it will be important to talk to your tax advisor to ensure that the correct rate of withholding tax is applied.

Annual NR4 Return Filing

Canadian payers are required to file form NR4 annually for every non-resident to whom they paid or credited certain types of income to during the year (even if non-resident tax was not required to be withheld). This includes rental income, and a full list of the types of income to which these rules apply can be found in Appendix B of the CRA’s NR4 – Non-Resident Tax Withholding, Remitting, and Reporting guide.

The NR4 return requires the payer to report information on the amounts and types of income paid to each non-resident recipient, as well as the applicable non-resident tax withheld from each type of income. You must give recipients their NR4 slips on or before the last day of March after the calendar year the slips apply to. A corresponding NR4 information return must also be filed with CRA slips on or before the last day of March after the calendar year to which the information return applies.

Penalties for Non-Compliance

If you failed to deduct the required amount of the Part XIII tax from the amount you pay or credit to a non-resident, you are liable for this amount even if you cannot recover the amounts (i.e. from your landlord or other non-resident recipient). The CRA may assess you for any amount owing.

The CRA can assess you for the amount of tax that you failed to deduct. The CRA can also assess a penalty of 10% of the required amount of Part XIII tax you failed to deduct.

The CRA can assess a penalty on the amount you failed to remit when one of the following applies:

-

you deduct the amounts, but do not remit them

-

the CRA receives the amounts you deducted after the due date

The penalty for remitting late is:

-

3% if the amount is one to three days late

-

5% if the amount is four or five days late

-

7% if the amount is six or seven days late

-

10% if the amount is more than seven days late or if no amount is remitted

If you are assessed either the failure to deduct or failure to remit penalty more than once in a calendar year, the CRA will apply a 20% penalty to the second or later failures if they were made knowingly or under circumstances of gross negligence.

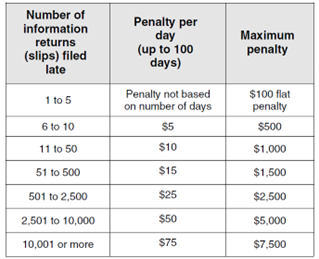

The CRA will assess a penalty if you file your information return late. For NR4 information returns, the CRA has an administrative policy that reduces the penalty that it assesses so it is fair and reasonable for small businesses. Each slip is an information return, and the penalty the CRA assesses is based on the number of information returns you filed late. The penalty is $100 or the amount calculated according to the chart below, whichever is more:

The penalty for failing to distribute or late distribution of NR4 slips to recipients is $25 per day for each such failure with a minimum penalty of $100 and a maximum of $2,500.

For more information on non-resident tax withholding requirements for amounts paid to non-resident, visit the CRA NR4 – Non-Resident Tax Withholding, Remitting, and Reporting guide webpage, or contact Gregory Harriman & Associates LLP by email at This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone at 1-403-934-3176.

Disclaimer

The information in this publication is current as of August 8, 2023.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact Gregory, Harriman & Associates LLP to discuss these matters in the context of your particular circumstances. Gregory, Harriman & Associates LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.